|

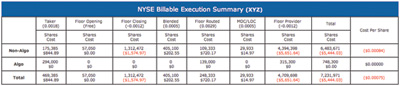

NYSE Billable Execution Summary

A summary designed to reflect execution costs incurred by your firm for all NYSE and Amex listed shares traded for a given trade date or range of dates include including a "Cost Per Share" calculation, sorted by NYSE trading fee/rebate, and by shares traded with and without the use of an Algo.

Benefit: NYSE Billable Execution Cost Analysis provides NYSE floor broker firms with a compact view of the costs incurred and rebates earned for NYSE and AMEX listed trading activity for a given trade date or range of dates for trading activity that is billable to your firm by NYSE. Your firm can recognize and track all NYSE transaction fees.

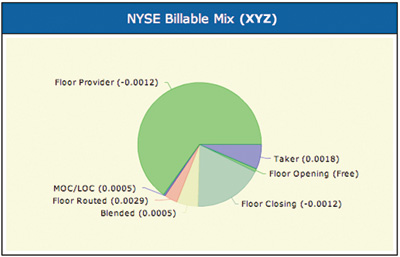

NYSE/AMEX Billable Mix Pie Chart

The Billable Mix Pie Chart is a graphic presentation of the percentage of the total share volume by a given trade date or range for trading activity to be billed to your firm by NYSE for each NYSE trading fee category. By rolling the cursor, each pie "slice" is enhanced to present the percentage of the total shares traded, Algo and non-Algo traded share volumes, and the total number of shares traded in the corresponding trading fee category.

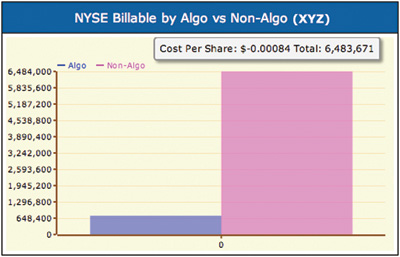

NYSE Billable by Algo vs. Non-Algo

The NYSE Billable by Algo vs. Non-Algo Bar Graph Chart is a graphic representation of the shares traded by a given trade date or range with and without the use of an Algo for trading activity in NYSE listed stocks to be billed to your firm by NYSE.

Your Member Firm will also have access to the same Billable Execution Cost Analysis for AMEX trade data.

|